For those who missed it: what is blockchain?

Blockchain is a database in the form of a chain. It consists of digital blocks which are connected to each other like links on a chain: each new block stores the data of the previous block.

These blocks contain information about transactions made with tokens: creation date, transfers, purchases, and sales. Tokens in blockchain can be anything, but most often we mean cryptocurrency, such as bitcoins, ethers, etc.

The reliability of blockchain technology is due to the distributed and unalterable information in the blocks:

- Transaction information is not stored on the servers of any one bank or government, but is distributed simultaneously to all network participants.

- Any participant can view the information in a block, but no one can delete or change it. The blocks are unalterable.

Nevertheless, it is still possible to steal tokens. For example, it’s possible to force or trick an owner into revealing their secret data from their digital wallet, for example, at a phishing website.

How NFTs work

We are used to seeing cryptocurrency as tokens in a blockchain. But the system can store any kind of information. The creators of the Ethereum platform decided that tokens do not have to be the same, or as interchangeable as coins. Tokens can be unique, like works of art. That’s how the idea of NFT — non-fungible (i.e., non-interchangeable) tokens — came about.

Non-fungible tokens, like crypto, live in a blockchain system. The system acts as a reliable database of transactions for them: any user can trace the history of a particular token. There are some differences: the rate of digital money is set by trading on an exchange, whereas the value of an NFTs is determined during an auction. NFTs cannot be divided, but it is easy to buy half of a bitcoin, for example.

NFTs are now used to sell works of art, musical compositions, collectibles, and digital items from computer games. But the point of an NFT is that the buyer of the token acquires only the rights to own the work of art. Not the work itself or the copyright to it, but a digital certificate, i.e., lines of code confirming that he or she owns the original.

The digital record of the item itself continues to be stored in the IPFS file system, which is also based on blockchain principles:

- The information is distributed: the files are divided into parts and stored with many participants;

- The information is unchanged: the files cannot be changed or deleted; they can only be added to.

Imagine you buy Van Gogh’s «Starry Night». You own it, but the painting itself continues to hang at the New York Museum of Modern Art. Images of it continue to be printed in books and on T-shirts, and downloaded from the Internet, but you don’t receive any royalties.

And what do you get? You get to enjoy the status of being a wealthy individual, an aesthete, and an art connoisseur, as well as the opportunity to resell the painting to another collector for even more money. And if you happen to be Van Gogh, you can also receive royalties from every resale of your NFT painting.

Why it’s being hyped now

NFT technology is not new. It first appeared back in 2014. But for a long time, it remained merely an interesting distraction, an amusement for crypto-geeks. But the foundation for the present popularity of NFTs was already laid by 2020:

- Finding themselves in isolation due to the corona virus, people began to spend more time online, looking for new forms of digital entertainment and financial tools.

- Investing became a much more popular trend, rather than simply the privilege of professionals. Many amateur investors appeared on the stock market.

These processes were superimposed on fresh memories of the rise of cryptocurrencies. People learned about this new and promising blockchain technology, and could invest in it right at the beginning. This was almost like «a chance to time travel back to 2008, and buy bitcoins for next to nothing.» Only now, instead of Bitcoin, it was NFT.

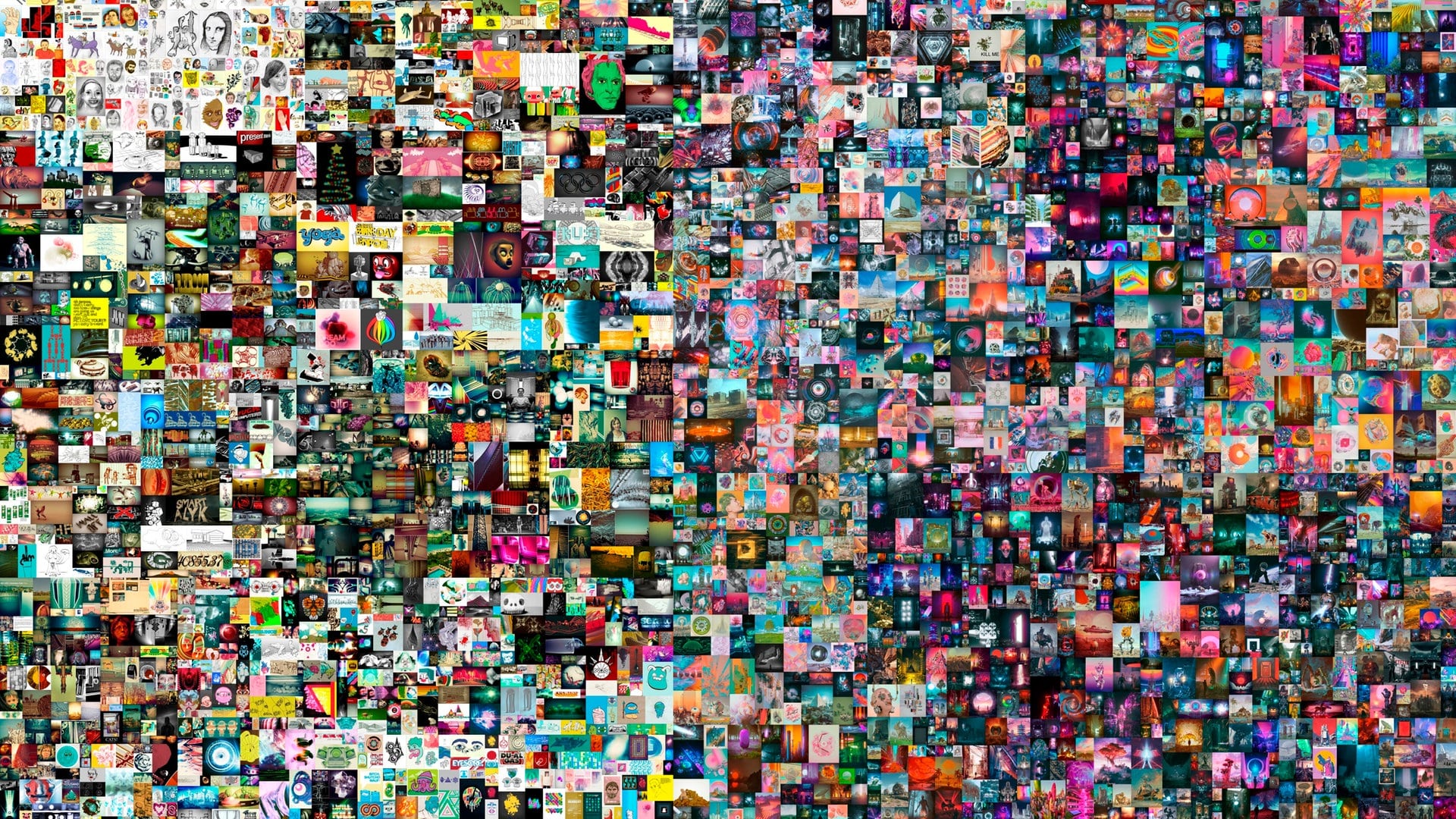

As a result, in 2021 there was a wave of hype. Beeple’s NFT work «The First 5000 Days» was bought for an unimaginable $ 69.3 million. How much was that again?! Everyone began wondering what the heck this thing was.

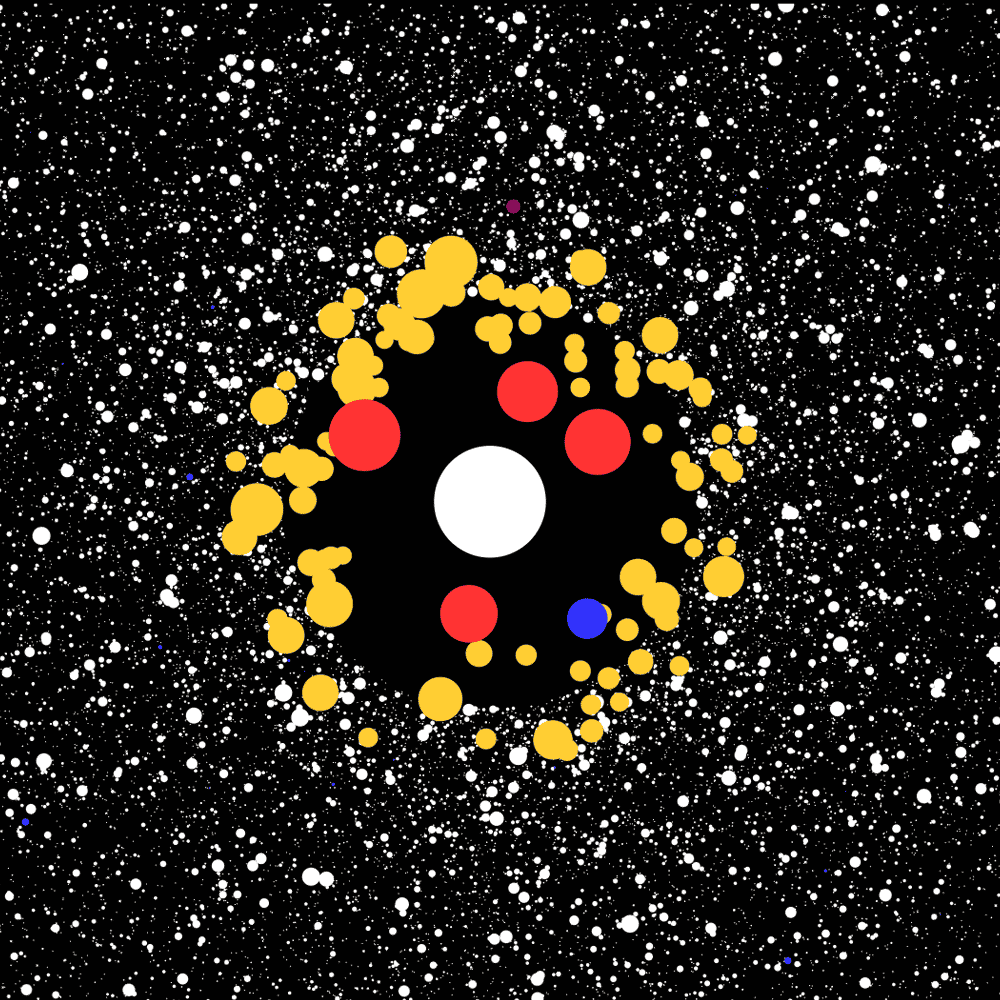

The next record was set by digital artist Pak. He created an NFT collection, called «The Merge», of 312,686 tokens with multicolored circles, which represent units of mass. The collection sold for a total of $ 91.8 million. This is the all-time record for the value of a work of art sold by a living artist. And not just an NFT work of art, but all works of art in total.

These gigantic sums attracted the interest of the general public. According to analytics service DappRadar, NFT sales rose from $ 1.3 billion in the second quarter of 2021, to $ 10.7 billion in the third.

Why NFTs are so wildly expensive

NFT developers know that the value of NFTs is born out of investors' expectations. People buy tokens because they believe they can resell them later at a higher price. What do these expectations consist of?

Market value

The ratio of supply and demand is like that on a stock exchange. The value is fueled by the popularity of the artist and the expected resale value of the asset.

For example, everything associated with Elon Musk sells instantly. Even if they are digital images and videos created by his wife and her brother, not by Elon himself.

Subjective value

The perception of a token as a work of modern art, or a unique collector’s item.

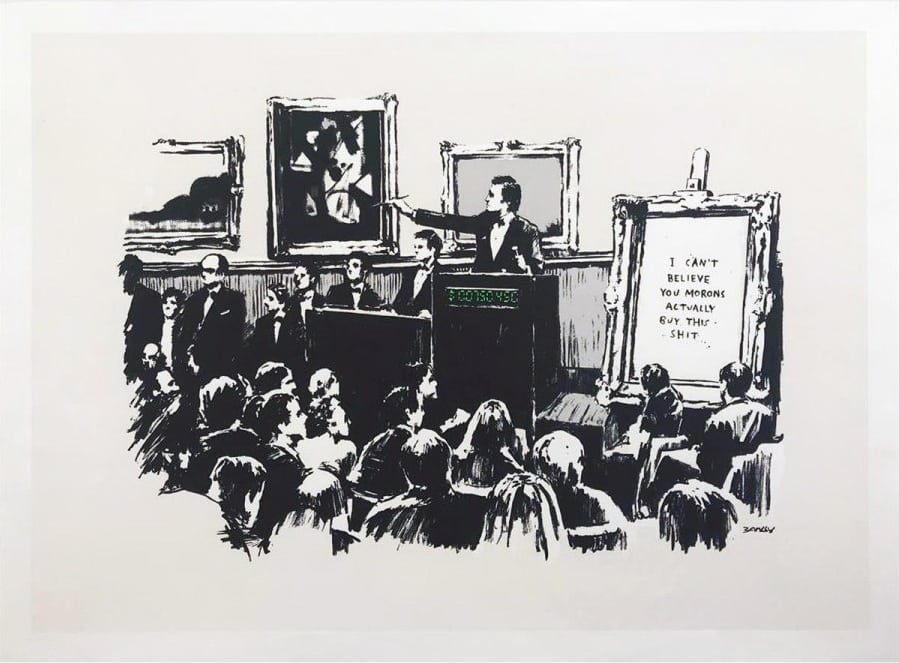

For example, the blockchain company Injective Protocol bought, for $ 95,000, a copy of Banksy’s work entitled «Morons (White)», signed by the author. It was made into an NFT and then burned. As a result, the value of the digital image increased fourfold: the token was sold for $ 380,000.

Objective value

The tangible benefits of owning an NFT in real or virtual life.

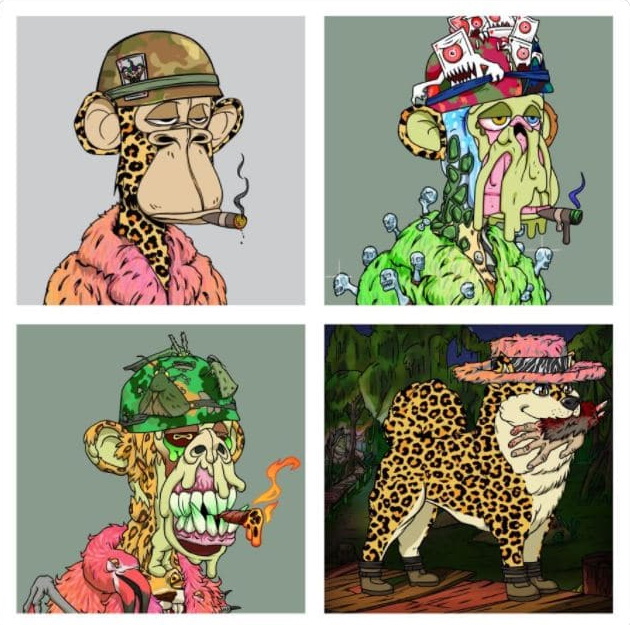

The «Ape NFT». For example, the NFT-project «The Bored Ape Yacht Club» is not just a set of cards with monkeys. Buyers get the right to commercially use the images. And the authors constantly come up with games and activities for club members. For example, token holders each get an NFT dog or serum that created a mutant version of their monkeys.

Historical value

An opportunity to capture something this moment, while history is being made, and earn on it later.

For example, the Malaysian businessman Estavi bought the creator of Twitter’s first tweet for $ 2.9 million in 2021, and a year later wanted to sell it for $ 50 million. But apparently it was too early: the auction price didn’t even reach $ 1 million. Perhaps it’ll work next time.

Where to buy and sell NFTs

NFT tokens are bought and sold on marketplaces. Many are specialized, where you can buy or sell a certain type of NFTs. For example:

- The Axie Marketplace, aka Axie Infinity Marketplace. Here you can buy and sell in-game characters and items for in-game money.

- The NBA Top Shot Marketplace, an NBA-licensed marketplace that sells NFT basketball memorable moments.

Here are some marketplaces that sell digital art, music, collectibles, pretty much everything:

- OpenSea

- Mintable

- Rarible

- SuperRare

- Nifty Gateway

- Binance NFT

Some platforms offer the ability to pay in dollars, such as Nifty Gateway, and NBA Top Shot. Others work only with cryptocurrency, and most of those use Ethereum blockchain, or their own protocols based on it.

| OrbitSoft has already developed a tool that increases profits from cryptocurrency trading: it monitors movement on exchanges, and analyzes and finds profitable differences in rates. | How OrbitSoft automated cryptocurrency exchange trading with a bot |

How to create an NFT

Artists, photographers, and musicians can create their own NFT tokens and sell them on marketplaces. The sequence of steps goes something like this:

- Create a piece of digital art.

- Get an ethereal cryptocurrency wallet.

- Choose a platform for placement.

- Bind the wallet to the account.

- Place the work on the Marketplace with a description and initial price.

The marketplace registers NFTs on the blockchain and charges a fee for doing so. This fee depends on the size and quality of the object. There must be cryptocurrency in your wallet to pay the commission. Some venues create NFTs only at the time of purchase, and deduct the commission from the profit of the sale. For example, OpenSea does this. In this case, you don’t have to pay anything when creating tokens. This attracts more artists to the site.

However, it’s worth keeping in mind that the technology does not guarantee that an artist or collector will be able to earn something from NFTs. Blockchain analytics platform Nansen studied the NFT market from January 2021 to February 2022, and concluded that only a third of the tokens for sale were profitable. Another third are sold for less than the commission for their issuance, and another third don’t sell at all. So, it’s worth thinking carefully before you buy or create an NFT. That is, unless you are Elon Musk.